Passive Income Ideas: Unlocking Financial Freedom

In today’s fast-paced world, many people search for ways to make money without constantly working. This is where the concept of passive income comes in. Passive income is money earned with minimal effort, often through investments or business ventures that generate ongoing revenue. This article will explore various passive income ideas to help you build wealth and achieve financial freedom.

Understanding Passive Income

Before diving into specific passive income ideas, it’s essential to understand what passive income truly means. Unlike active income, which requires you to work for every dollar earned, passive income allows you to make money even when you’re not actively working. Here are some key characteristics:

- Minimal Effort: Passive income streams typically require little ongoing effort once set up.

- Multiple Sources: Successful passive income strategies often involve diversifying income streams.

- Long-Term Investments: Many passive income ideas require an upfront investment of time or money, with later returns.

Benefits of Passive Income

Why should you consider generating passive income? Here are a few compelling reasons:

- Financial Freedom: With passive income, you can achieve financial independence, allowing you to live on your terms.

- Less Stress: Multiple income streams can reduce financial stress and provide peace of mind.

- More Time for Hobbies: With the extra income, you can spend more time doing what you love.

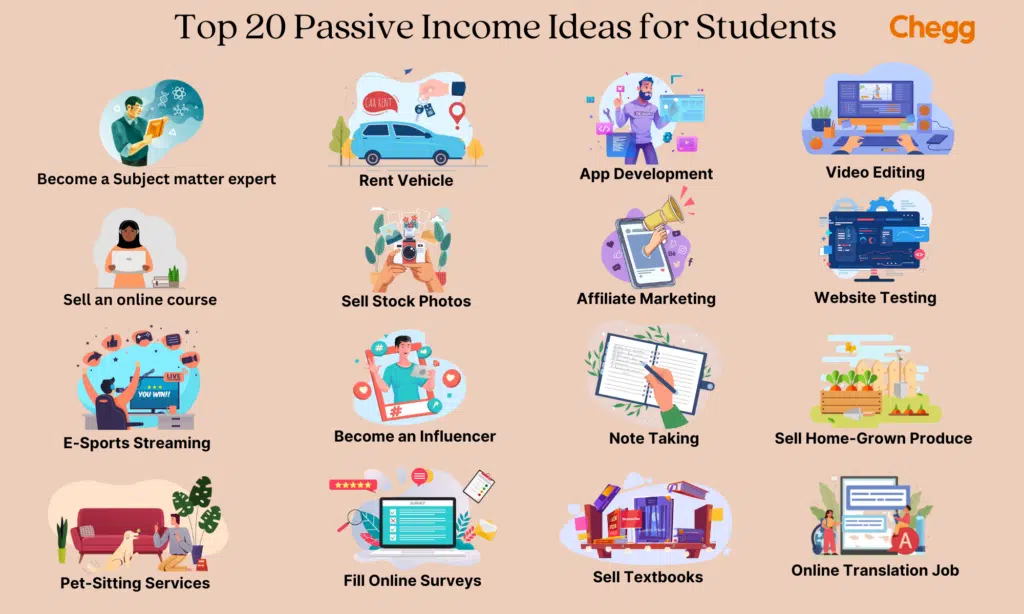

Top Passive Income Ideas

Now that we’ve covered the basics, let’s explore some practical passive income ideas you can implement to start earning today.

Real Estate Investments

Real estate is one of the most popular and effective passive income ideas. By investing in rental properties, you can generate a steady stream of income. Here are some options within real estate:

- Residential Rentals: Purchase single-family homes or apartments and rent them out.

- Vacation Rentals: Use platforms like Airbnb to rent your property to travellers.

- Real Estate Investment Trusts (REITs): Invest in REITs to earn dividends without owning physical property.

Dividend Stocks

Investing in dividend-paying stocks is another excellent way to generate passive income. Here’s how it works:

- Buy Shares: Purchase shares of companies that pay dividends.

- Receive Dividends: You’ll earn a portion of the company’s profits, usually quarterly.

- Reinvest or Cash Out: Decide whether to reinvest the dividends for more shares or take the Cash.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow you to lend money to individuals or small businesses in exchange for interest payments. Here’s what you need to know:

- Choose a Platform: Sign up for a reputable P2P lending platform.

- Fund Loans: Lend money to borrowers based on their creditworthiness.

- Earn Interest: Collect interest payments as borrowers repay their loans.

Create an Online Course

Creating an online course can be a fantastic passive income idea if you have expertise in a particular area. Here’s how to get started:

- Identify Your Niche: Choose a subject you’re passionate about and knowledgeable in.

- Create Content: Develop video lessons, quizzes, and other resources.

- Sell Your Course: Use platforms like Udemy or Teachable to market and sell your course.

Write an E-book

Writing an e-book is another way to leverage your knowledge for passive income. Here’s a simple approach:

- Choose a Topic: Pick a subject that interests you and has an audience.

- Write and Edit: Create the content, then edit it for clarity and quality.

- Publish and Promote: Self-publish your e-book on platforms like Amazon Kindle Direct Publishing.

Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for every sale made through your referral. Here’s how to do it:

- Select a Niche: Focus on a specific area that interests you.

- Join Affiliate Programs: Sign up for programs related to your niche, like Amazon Associates.

- Create Content: Build a website or blog to review and promote products.

Start a Blog or YouTube Channel

Creating a blog or YouTube channel can lead to various passive income opportunities, including advertising revenue and sponsorships. Here’s how to get started:

- Choose Your Topic: Find a niche you’re passionate about and knowledgeable about.

- Create Quality Content: Regularly produce engaging content that attracts viewers.

- Monetize: Use ads, affiliate marketing, or sponsorships to generate income.

Rent Out Assets

If you have assets that you’re not using, consider renting them out for extra Cash. Here are some ideas:

- Vehicles: Rent out your car on platforms like Turo.

- Equipment: Rent out tools, cameras, or other equipment you own.

- Storage Space: If you have extra space, consider renting it out as storage.

High-Interest Savings Accounts

While not the most exciting option, high-interest savings accounts can provide a reliable, albeit modest, source of passive income. Here’s how it works:

- Open an Account: Find a bank that offers competitive interest rates.

- Deposit Funds: Transfer your savings into the account.

- Earn Interest: Watch your money grow through interest accrual over time.

Tips for Success in Passive Income Ventures

While passive income ideas can provide substantial rewards, success often requires careful planning and execution. Here are some tips to help you on your journey:

Do Your Research

Before diving into any passive income venture, take the time to research your options thoroughly. Understand the risks, potential returns, and market trends to make informed decisions.

Diversify Your Income Streams

Relying on one source of passive income can be risky. Aim to diversify by exploring multiple ideas. This way, if one stream slows down, others can support you.

Set Realistic Goals

Setting clear, achievable goals is crucial. Decide how much passive income you want to generate and create a plan to reach that target over time.

Stay Consistent

Many passive income ideas require an initial time or financial investment. Stay committed to your efforts, even if you don’t see immediate results.

Monitor Your Investments

Monitor your passive income sources regularly. This will allow you to make adjustments and optimize your strategies for better returns.

Common Misconceptions About Passive Income

As with any financial concept, misconceptions about passive income can hinder success. Let’s address a few common myths:

Passive Income is Completely Effortless

While passive income can lead to less day-to-day work, it often requires significant upfront effort. Whether it’s creating content, setting up a rental, or managing investments, you’ll need to put in work initially.

You Need a Lot of Money to Start

Many passive income ideas don’t require substantial capital. Options like blogging, affiliate marketing, and creating online courses can be started with minimal financial investment.

It’s a Get-Rich-Quick Scheme

Passive income isn’t a shortcut to instant wealth. It requires dedication, strategy, and time to build and grow effectively.

Conclusion

Exploring passive income ideas is a step toward financial independence and greater life flexibility. By diversifying your income streams, researching thoroughly, and staying committed to your goals, you can create lasting wealth and enjoy the freedom that comes with it. Remember, every journey starts with a single step, so take the plunge today and watch your financial future flourish!

Summary Table of Passive Income Ideas

Passive Income IdeaDescriptionPotential Earnings

Real Estate Investments: Renting properties or investing in REITs Varies by location.

Dividend Stocks Earning dividends from stock investments Varies by stock

Peer-to-Peer Lending Lending money for interest 5% – 15% returns

Online Courses Selling educational content $100 – $10,000+

E-books Publishing written works $1 – $10,000+

Affiliate Marketing Earning commissions by promoting products Varies widely.

Blogging/YouTube Monetizing content through ads and sponsorships $0 – $100,000+

Renting Assets Earning income by renting out vehicles or equipment $50 – $2,000+

High-Interest Savings Earning interest on savings accounts is Low but steady.

Embrace these passive income ideas and start your journey toward financial freedom today.